Section outline

-

-

A financial analysis is performed by professionals who prepare reports using ratios that make use of information taken from financial statements and other reports. These reports are usually presented to top management as one of their bases in making business decisions. Financial analysis may determine if a project/business will:

- Continue or discontinue its main operation or part of its business;

- Make other decisions that allow management to make an informed selection on

various alternatives in the conduct of its business.

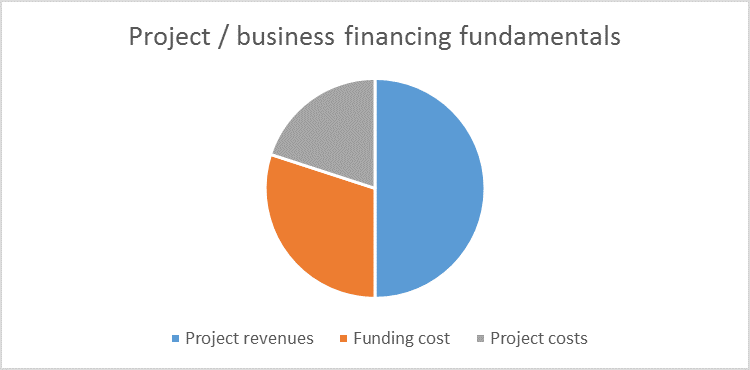

Basically, a business or project is financially viable if the revenues exceed the funding cost and project/business costs. The relationship between project revenues and expenses comprising both funding cost and project costs for any business or project can be captured as in the figure below:

When the blue area - project revenue - is smaller than the funding and project costs, the business is financially not viable. A financially viable project/business has higher revenues than project cost and funding cost.

Revenue

Projected revenue refers to the estimated money a project/company will generate during a specific period. These projections may be monthly, quarterly or annual. Revenues or sales is the amount of money that is brought into a project/company by its business activities. There are two main ways of calculating revenue. These depend on the accounting method a business employs.

Accrual accounting includes sales made on credit as revenue, as long as the goods or services have been delivered to the customer. In accrual accounting one needs to look at the cash flow statement too, to assess how efficiently a company collects the money it is owed.

Cash accounting only count sales as revenue if the payment has been received. When cash is paid to a company, this is known as a "receipt" to distinguish it from revenue. It is possible to have receipts without revenue. For example, if the customer paid in advance for a service that has not been rendered or goods that have not been delivered, this activity leads to a receipt, but not revenue.

Revenue can be divided into operating revenue or sales from a company's core business, and non-operating revenue which is derived from other secondary sources. As these non-operating revenue sources are often not predictable or recurring, they can be referred to as one-time events or gains.

In the case of government, revenue is the money received from taxation, fees, fines, inter-governmental grants or transfers, securities sales, mineral rights and resource rights, as well as any sales that are made.

Funding costs

Debt and equity are the two main components that constitute a project’s capital funding. Lenders and equity holders will expect to receive certain returns on the funds or capital they have provided. Since cost of capital is the return that equity owners (or shareholders) and debt holders will expect, so WACC indicates the return that both kinds of stakeholders (equity owners and lenders) can expect to receive.

To help understand WACC, try to think of a project/company as a pool of money. Money enters the pool from two separate sources: debt and equity. Proceeds earned through project/business operations are not considered a third source because, after a company pays off debt, the company retains any leftover money that is not returned to shareholders (in the form of dividends) on behalf of those shareholders.

Suppose that lenders require a 10% return on the money they have lent to a firm, and suppose that shareholders require a minimum of a 20% return on their investments to retain their holdings in the firm. On average, then, projects funded from the company’s pool of money will have to return 15% to satisfy debt and equity holders. The 15% is the WACC. If the only money in the pool was $50 in debt holders’ contributions and $50 in shareholders’ investments, and the company invested $100 in a project, to meet the lenders’ and shareholders’ return expectations, the project would need to generate returns of $5 each year for the lenders and $10 a year for the company’s shareholders. This would require a total return of $15 a year, or a 15% WACC.

Risk identification and allocation is a key component of project funding. A project may be subject to several technical, environmental, economic and political risks, particularly in developing countries and emerging markets. Financial institutions and project sponsors may conclude that the risks inherent in project development and operation are unacceptable (unfinanceable).

Project Cost

Project cost is the operating cost of the project, which is required for smooth operation and maintenance of the project.

- Continue or discontinue its main operation or part of its business;

-